capital gains tax proposal effective date

The effective date for the capital gains tax hike would be April 28 2021 when the American Families plan was introduced according to the Treasury Departments Greenbook a compendium of. Taxpayers can consider triggering gain before the potential effective date of a capital gains change but should assess the outlook carefully and understand the risk.

Speech Preparation Outline Example Speech Outline Transition Words Writing Forms

A number of exclusions to the proposed capital gain rules would apply.

. Effective Date Considerations May 14 2021. The effective date would be retroactive to April 28 2021 the date President Biden first unveiled his proposals. 1 2022 or later for most other proposed changes.

When Will the Tax Go into Effect. If this were to happen it may not only. Including a 38 Medicare surtax on high earners the top capital gains rate would be 288 taking effect in tax years ending after Sept.

Understanding Capital Gains and the Biden Tax Plan Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. 13 2021 unless pursuant to a written binding contract effective on or before Sept. Increase the top capital gains rate to 318 percent 25 percent statutory rate 38 percent NIIT 3 percent surtax.

Catching Up on Capitol Hill Episode 13-2021 President Biden has proposed a substantial increase in the capital gains rate. Bidens Capital Gains Proposal. Proposed effective dates on the capital-gains tax rate were a big open question.

Under current proposals the long-term capital gains tax would increase to the taxpayers highest marginal tax rate of 396 for those with adjusted gross incomes over 1 million. The Green Book says this. The Biden administration proposed that its capital gains tax increase apply to gains required to be recognized after the date of announcement presumably late April 2021 The House proposes that its capital gains increase apply to sales on or after Sept.

The Green Book indicated the capital gain hike would be effective for gains required to be recognized after the date of announcement Secretary Yellen intimated that date would be April 28. The CGT will go into effect for taxable years beginning on or after January 1 2022 provided Governor Jay Inslee signs the legislation which is expected. The proposal would be effective for gains on property transferred by gift and on property owned at death by decedents dying after December 31 2021 and on certain property owned by trusts partnerships and other non-corporate entities on January 1 2022.

This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28 2021 although it was not widely publicized at the time and investors are still becoming aware of it. An immediate effective date would prevent taxpayers from selling assets and engaging in transactions ahead of the rate. The proposed effective date is for taxable years beginning after December 31 2021.

The effective date for the capital gains tax hike would be April 28 2021 when the American Families plan was introduced according to the Treasury Departments Greenbook a compendium of. It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021. Proposed effective dates on the capital-gains tax rate were a big open question.

Thats far short of the 396 rate --. Effective Date Considerations KPMG Catching Up on Capitol Hill Podcast Episode 13-2021 Its not just the how much the capital gains tax rate may increase its the when. Which leads to the oft-asked question of when.

In short we dont yet know the answer to this important question. Taxpayers can also consider other rate arbitrage opportunities as Democrats are largely proposing effective dates of Jan. Should the proposals become law your client will now pay federal capital gains tax of 740000 in 2021 and 792000 in 2022 and 2023.

This proposal would be effective for gains required to be recognized after the date of announcement. This will affect long-term and short-term capital gains since both would be taxed as ordinary income in the highest bracket. Bidens Capital Gains Proposal.

Were Here to Help. This proposal is lower than the 434 percent top capital gains rate proposed by the president for those with adjusted gross incomes exceeding 1 million. Dems eye pre-emptive capital gains effective date.

The Wall Street Journal first reported the retroactive effective-date proposal on Thursday. House Democrats propose raising capital gains tax to 288 Published Mon Sep 13 2021 333 PM EDT Updated Mon Sep 13 2021 406 PM EDT Greg Iacurci GregIacurci. Long-term capital gains and qualified dividend income currently 20 will be subject to ordinary income tax rates of up to 396 percent as opposed to the current ability of paying lower preferential tax rates on these forms of income.

The proposal will increase the capital gains tax rate for households that make over 1 million. Democratic lawmakers have quietly begun discussing whether to make a proposed increase in the individual capital gains rate effective on the date the proposal is introduced. This is a total of 1124000 additional tax.

Currently taxpayers pay an income tax rate ranging from zero to 20 when realizing capital gains on assets held for more than 12 months.

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

Taxation Changes In Indonesia Under Tax Regulation Harmonization Law

Tax Policy Measures In Advanced And Emerging Economies A Novel Database In Imf Working Papers Volume 2018 Issue 110 2018

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

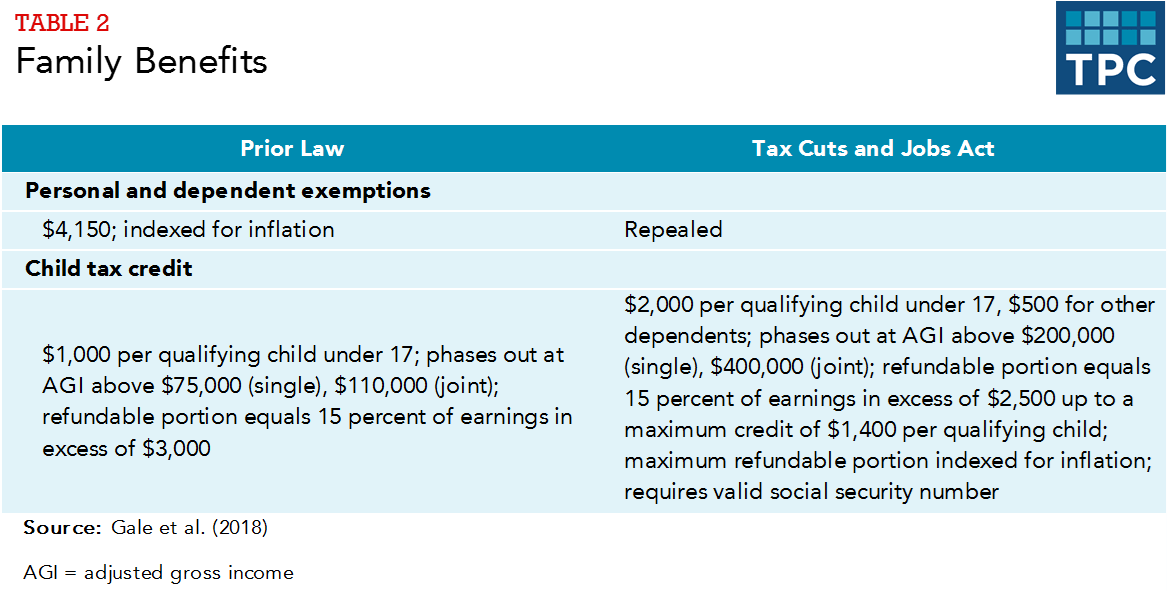

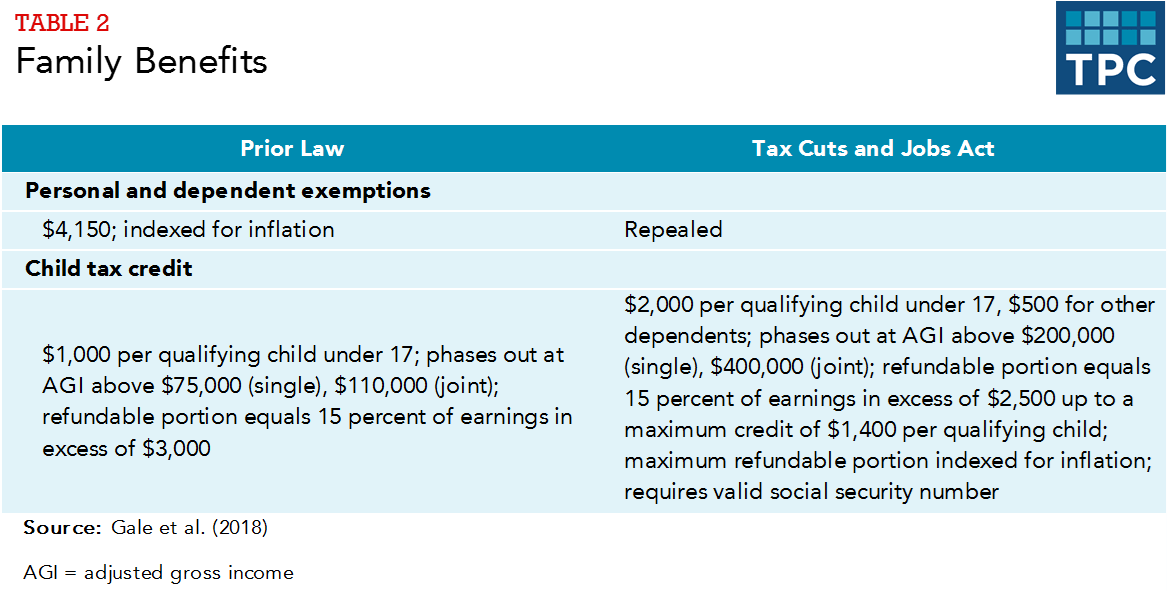

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Sahaj Gst Return New Gst Return Filing Form Masters India Receipt Maker Paying Taxes Tax Payment

Tax Policy And Inclusive Growth In Imf Working Papers Volume 2020 Issue 271 2020

Biden S Better Plan To Tax The Rich Wsj

No More Extension Of Last Date For Filing Audit Reports Income Tax Returns In 2021 Income Tax Return Income Tax Tax Return

Ch01 Solution W Kieso Ifrs 1st Edi

How The Tcja Tax Law Affects Your Personal Finances

Tax Proposals Under The Build Back Better Act Version 2 0

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

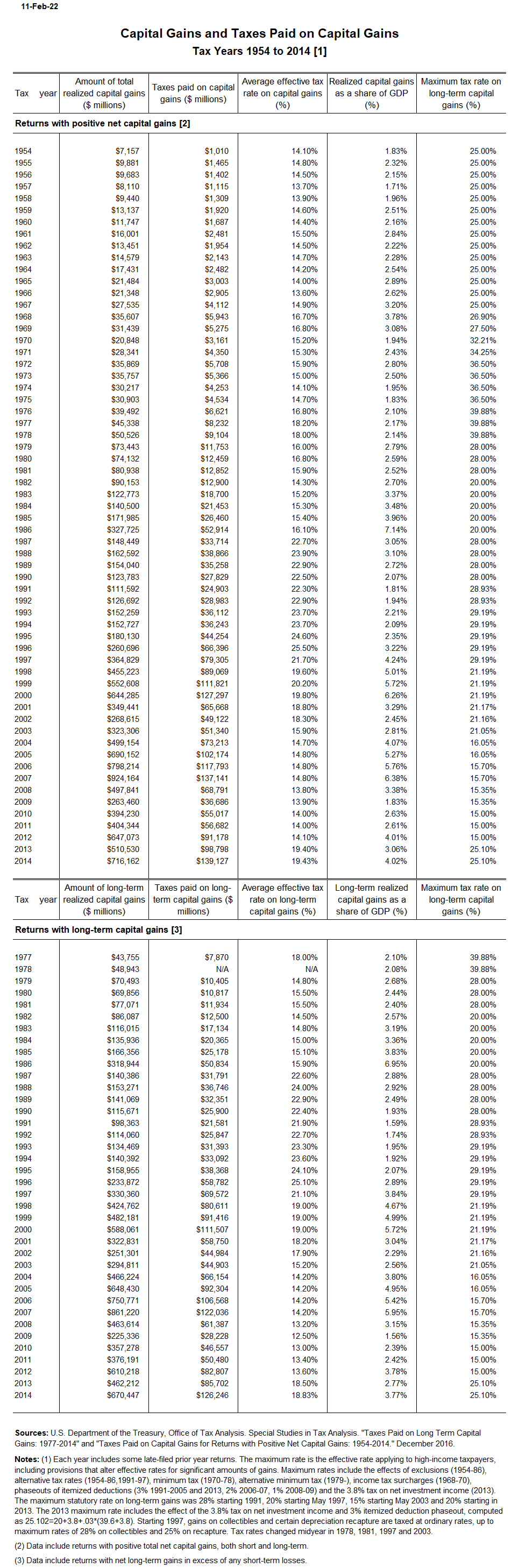

Historical Capital Gains And Taxes Tax Policy Center

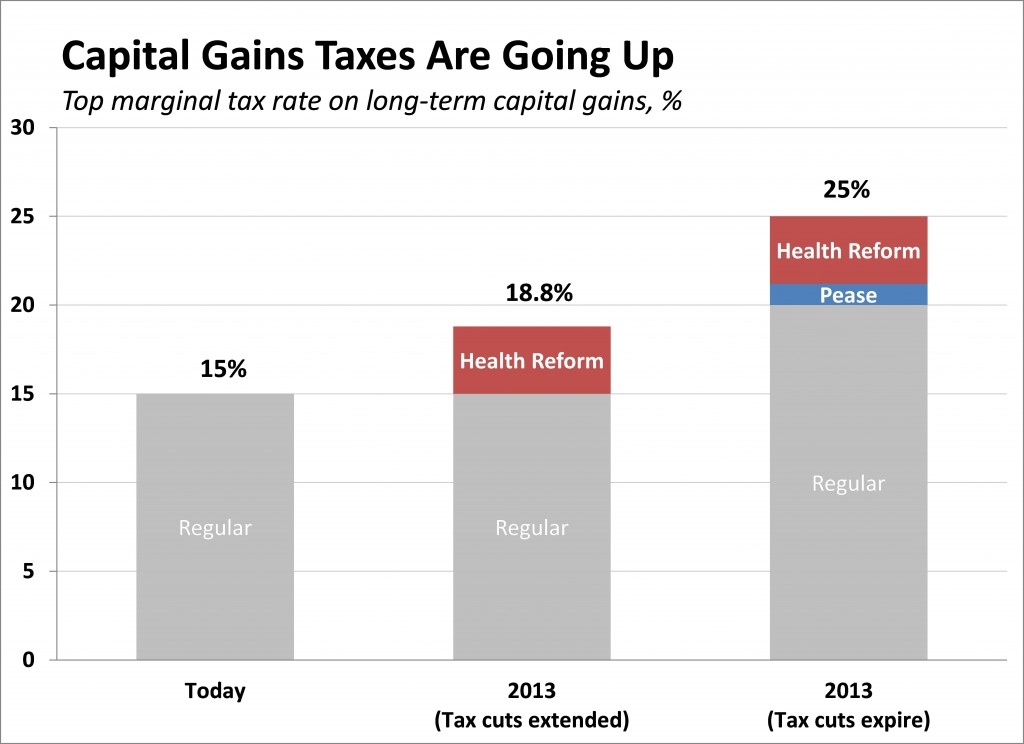

Capital Gains Taxes Are Going Up Tax Policy Center

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary