unemployment tax refund update 2021

September 13 2021. The IRS plans to send another tranche by the end of the year.

Irs Tax Refund Delays Persist For Months For Some Americans Abc7 Chicago

The first 10200 of 2020 jobless benefits 20400 for married couples filing jointly was made nontaxable income by the American Rescue Plan in March.

. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in 2020. That provision didnt apply to 2021 benefits so you may receive a tax bill for your jobless benefits last year. For individuals it excludes up to 10200 of their unemployment compensation from their gross income if their modified adjusted gross income is less than 150000.

The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in. When youre ready to file your tax return for 2021 write the amount stated in box 1 of your Form 1099-G on line 7 of Schedule 1 Additional Income and Adjustments to Income. Waiting for your unemployment tax refund about 436000 returns are stuck in the irs system.

The IRS Tax Notice CP101 form is issued to the tax payers to inform them about the changes that the IRS has made on their Employers Annual Federal Unemployment Tax FUTA Return. TAS Tax Tip. Irs unemployment tax refund august update.

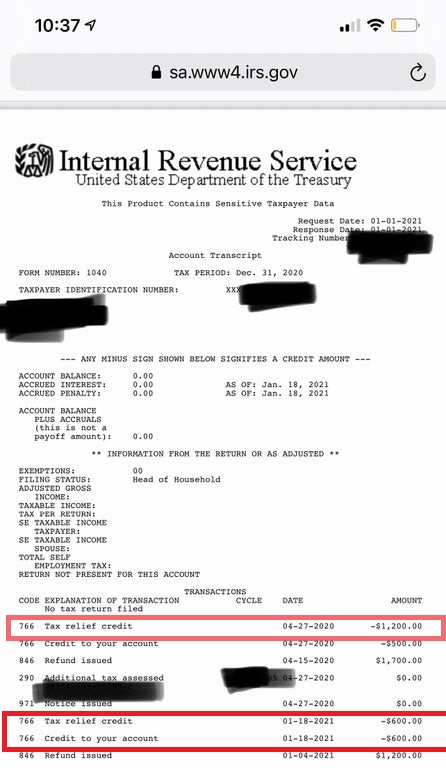

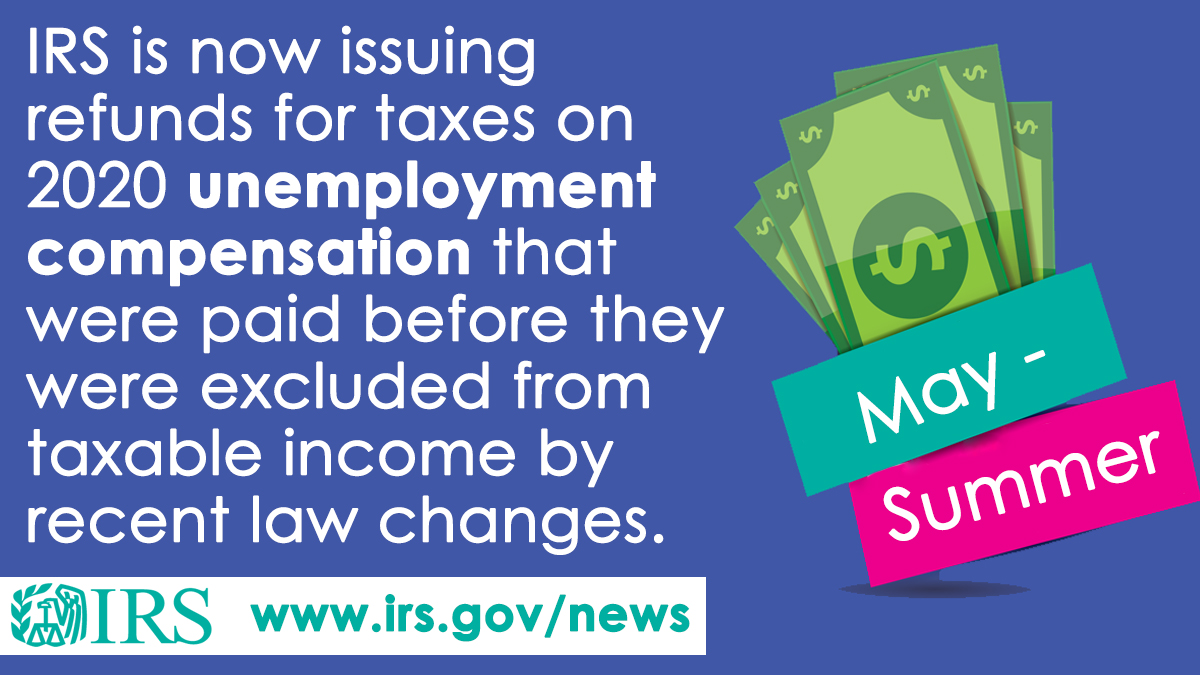

Since May the IRS has been making adjustments on 2020 tax returns and issuing refunds averaging around 1600 to those who can claim an unemployment tax break. The American Rescue Plan exempted 2020 unemployment benefits from taxes. The federal tax code counts jobless benefits as.

More 2021 unemployment compensation exclusion adjustments and refunds in some cases coming. Heres what to know about paying taxes on unemployment benefits in tax year 2021 the return youll file in 2022. Taxpayers whose refunds are used by the IRS to cover existing payment obligations should receive a CP49 notice in the mail.

Changes in how Unemployment Benefits are taxed for Tax Year 2020. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. This Notice addresses the unemployment compensation exclusion also unemployment exclusion in the federal American Rescue Plan Act 1 and its effect on the taxable income of Michigan resident taxpayers under the Michigan Income Tax Act.

2 This Notice is an update to the Notice published April 1 2021 and provides guidance to. Ad Learn How Long It Could Take Your 2021 State Tax Refund. In the latest batch of refunds announced in November however the average was 1189.

Line 7 is clearly labeled Unemployment compensation 3 The total amount from the Additional. By jul 30 2021 tax tips and news. See How Long It Could Take Your 2021 State Tax Refund.

Even if you dont owe the IRS money the agency can keep your tax refund. IR-2021-159 July 28 2021. Thats the same data.

The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year. IRS readies nearly 4 million refunds for unemployment compensation overpayments. This means you have to include that income in your 2021 tax return despite that the money is technically for the unemployment period in 2020.

May 26 2021 Update on the Federal Unemployment Benefits Deduction for Taxpayers Who Filed Prior to the Enactment of the American Rescue Plan Act On April 6 2021 the Department of Taxation issued the tax alert Ohio Income Tax Update. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. Last year the government imposed no taxes on those who received up to 10200 of benefits in 2020 as part of the COVID-19 relief law the American Rescue Plan Act.

1222 PM on Nov 12 2021 CST. Another 15 million taxpayers are now slated to get refunds averaging over 1600 as part of the irs adjustment process in the wake of recent legislation. WASHINGTON The Internal Revenue Service announced today it will issue another round of refunds this week to nearly 4 million taxpayers who overpaid their taxes on unemployment compensation received last year.

An estimated 13 million taxpayers are due unemployment compensation tax refunds. The irs is recalculating refunds for people whose agi is 150k or below and who filed before the tax law that changed the amount of unemployment that. Irs unemployment tax refund august update.

IR-2021-151 July 13 2021. Another 15 million taxpayers will receive their unemployment tax refunds as the IRS continues to adjust returns based on a provision of the. During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes.

Under the American Rescue Plan Act of 2021 Americans who received unemployment compensation in 2020 received relief. WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year.

The agency had sent more than 117 million refunds worth 144 billion as of Nov. You must file Schedule 1 with your Form 1040 or 1040-SR tax return. When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020.

2 This Notice is an update to the Notice published April 1 2021 and provides guidance to. Thousands of taxpayers may still be waiting for a. 4 weeks after you mailed your return.

The update says that to date the IRS has issued more than 117 million of these special refunds totaling 144 billion. This Notice addresses the unemployment compensation exclusion also unemployment exclusion in the federal American Rescue Plan Act 1 and its effect on the taxable income of Michigan resident taxpayers under the Michigan Income Tax Act. According to senior fellow and.

In its latest update the tax agency said it had released more than 10 billion in jobless tax refunds to nearly 9. Irs unemployment tax refund august update. This tax alert provided.

The IRS reported that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust taxable income amounts based on the exclusion for unemployment compensation from previously filed income tax returns. The most recent batch of unemployment refunds went out in late july 2021. The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time.

This tax break was applicable.

Unemployment Tax Updates To Turbotax And H R Block

When To Expect Unemployment Tax Break Refund Who Will Get It First As Usa

Waiting For Your Unemployment Tax Refund About 436 000 Returns Are Stuck In The Irs System

Confused About Unemployment Tax Refund Question In Comments R Irs

Interesting Update On The Unemployment Refund R Irs

Unemployement Benefits Will I Get A Tax Refund For This Benefit Marca

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Will My Irs Tax Transcript Help Me Find Out When I Ll Get My 2022 Refund And What Does It Mean When Transcript Says N A Aving To Invest

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Unemployment Tax Refund Will You Get A Refund For This Benefit Marca

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

Irsnews On Twitter Irs Is Issuing Refunds For Taxes On 2020 Unemployment Compensation That Were Paid Before They Were Excluded From Taxable Income By Recent Law Changes Details At Https T Co Hcqbfq5oze Https T Co Tt4lhu7uff

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa